You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tipping when 20% tip is already (and openly) added to the bill.

- Thread starter larry_stewart

- Start date

The friendliest place on the web for anyone that enjoys cooking.

If you have answers, please help by responding to the unanswered posts.

If you have answers, please help by responding to the unanswered posts.

Can you change that before paying? Isn't that a bit of a PITA?When we were out recently, i did a QRC payment. The default tip amount was 22%.

GinnyPNW

Master Chef

They "hate" us...we make them take cash.Can you change that before paying? Isn't that a bit of a PITA?

Andy M.

Certified Pretend Chef

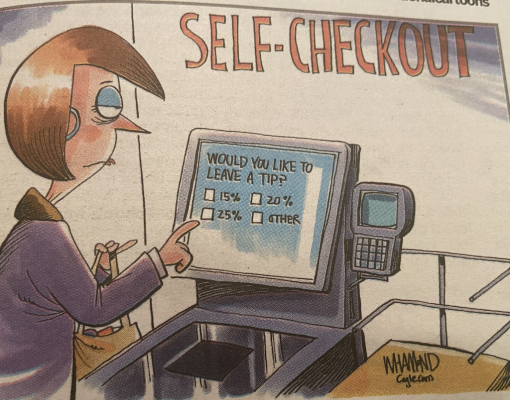

In CT this week, every restaurant had suggested tip amounts on the check. 15%, 20% 25%.

Yes, you could change it to custom or other percentages that were listed, starting at 20% BTW and going up to 30%. The 22% was just the default amount. We normally tip cash at diner, sports bar type places, which this was. I changed it to zero and left cash.Can you change that before paying? Isn't that a bit of a PITA?

Yes, it is a PITA and I resent having to change it. It's like those negative opt out email type things.

Even our normal diner place has gone to 20% default tip, which Craig didn't notice when he paid the bill the last time so our waitress got double tipped. It was only $8 though and she is our favorite and always gives good service, but I'll be reminding him to check next time.

They’ve been doing that here for a long time. You have to watch though. Some places do the percentage AFTER tax is added, which in a high end restaurant can make a big difference. Tip should be calculated BEFORE tax.In CT this week, every restaurant had suggested tip amounts on the check. 15%, 20% 25%.

I agree that the tip should be before the tax, but I honestly can't say I have ever seen it done that way, not even in Denmark, when the tip wasn't included in the price, but always added to the bill.They’ve been doing that here for a long time. You have to watch though. Some places do the percentage AFTER tax is added, which in a high end restaurant can make a big difference. Tip should be calculated BEFORE tax.

But if the tip is added before tax - then are you also paying tax on the tip? Or is it like at the grocers where some stuff is taxed and others not, the end tax is just on the taxable things.

I believe those hand held machines should be able to distinguish but ....

I believe those hand held machines should be able to distinguish but ....

No, you don't get taxed on the tip. What I mean is say your bill for food alone is $100. Tip of 20% on that would be $20. Once tax is added, say 7% in my area, the total bill is now $107. So, if tip is figured on that, it would be $21.40. Granted, that extra $1.40 is not a lot, but your server did nothing for that $1.40 and there are a lot of restaurants in my area that a bill for 4 people with drinks and wine can be $150-200 per person or even more. Plus, in the beach/tourist areas, there is an additional 0.5-2% tax added on top of the 7%.But if the tip is added before tax - then are you also paying tax on the tip? Or is it like at the grocers where some stuff is taxed and others not, the end tax is just on the taxable things.

I believe those hand held machines should be able to distinguish but ....

The restaurants decide the default tip percentage, plus the other offered percentages, and whether or not the tip is figured before or after tax.

Have to admit, I've wondered what happens to the tip difference between before and after tax, i.e. whether server gets it or it mysteriously "disappears" from their tips for the day since most places figure tip on before tax amount.

Andy M.

Certified Pretend Chef

One of the restaurant checks last week actually stated that suggested tips were calculated on the pre-tax amount.They’ve been doing that here for a long time. You have to watch though. Some places do the percentage AFTER tax is added, which in a high end restaurant can make a big difference. Tip should be calculated BEFORE tax.

For my visit to Pizza Express yesterday, with 2 friends, we got the bill, added 10% onto the total, then split that 3 ways and each paid by card. For each card payment, we then said "no" to the tip that was being suggested as we had already accounted for it in the amounts we were paying. I explained this to the waitress and all was well.

Aunt Bea

Master Chef

That’s interesting to me.For my visit to Pizza Express yesterday, with 2 friends, we got the bill, added 10% onto the total, then split that 3 ways and each paid by card. For each card payment, we then said "no" to the tip that was being suggested as we had already accounted for it in the amounts we were paying. I explained this to the waitress and all was well.

It never occurred to me that you could split a credit card bill but it makes perfect sense.

Definitely a

Well, with contactless payment, it is pretty easy. We just told the waitress how much for each payment, she keyed it into her handheld device, and we wafted our cards. All done in moments! (When technology works, it is a wondrous thing!) When it doesn't, it is an utter nightmare! (Witness me at any supermarket when forced to use one of those awful self-service kiosks!) I will wait a long time, endure slow customers, fumbled payments - anything - rather than go to a self service kiosk thing! (I went to one yesterday - and obviously one of my 4 items would not scan for love nor money - I loathe them!) Okay, rant over.That’s interesting to me.

It never occurred to me that you could split a credit card bill but it makes perfect sense.

Definitely amoment for me!

msmofet

Chef Extraordinaire

- Joined

- Apr 5, 2009

- Messages

- 14,179

For my visit to Pizza Express yesterday, with 2 friends, we got the bill, added 10% onto the total, then split that 3 ways and each paid by card. For each card payment, we then said "no" to the tip that was being suggested as we had already accounted for it in the amounts we were paying. I explained this to the waitress and all was well.

Where I live they don't do that.That’s interesting to me.

It never occurred to me that you could split a credit card bill but it makes perfect sense.

Definitely amoment for me!

AND just about EVERYWHERE (even the eye doctor) charges you extra because the business passes along the credit card company surcharge to the customer. I don't think that should be allowed. The business excepts credit cards, they should pay the fee (not me) or only take cash. I ONLY pay cash for gas. They shouldn't make me pay their fee.

I agree with you msmofet. If all their customers are paying with a credit card, the fee charged to them is less. I don't remember when the charge by the credit card company is applied but I'm pretty sure that for those companies who mostly only accept cards, the fee must be down pretty much to negligible.

credit card fees are in the single digits - but they are by no means negligible.

and not every card 'costs' the merchant the same -

the 'reward' cards - cash back/mileage/etc . . . - thank the merchant because those rewards come out of his hide.

and not every card 'costs' the merchant the same -

the 'reward' cards - cash back/mileage/etc . . . - thank the merchant because those rewards come out of his hide.

single digits? well, they certainly were not when they charged me for my deposits.

which single digit are you referring to? and based on what total - bbecause they do change with the amounts.

which single digit are you referring to? and based on what total - bbecause they do change with the amounts.

yah, no kidding.

Walmart wanted to make its own bank so it could capture the fees.

with credit card charges running to $200k+/year the fees were in single digits.

if you're paying 10% or more of gross billings, you're being ripped off.

(not uncommon, , , btw)

Walmart wanted to make its own bank so it could capture the fees.

with credit card charges running to $200k+/year the fees were in single digits.

if you're paying 10% or more of gross billings, you're being ripped off.

(not uncommon, , , btw)

Similar threads

- Replies

- 41

- Views

- 1K

- Replies

- 0

- Views

- 426

- Replies

- 17

- Views

- 569